A step-by-step process for filing the sales tax return in Michigan

Let's get right into the steps for filing sales tax returns in Michigan.

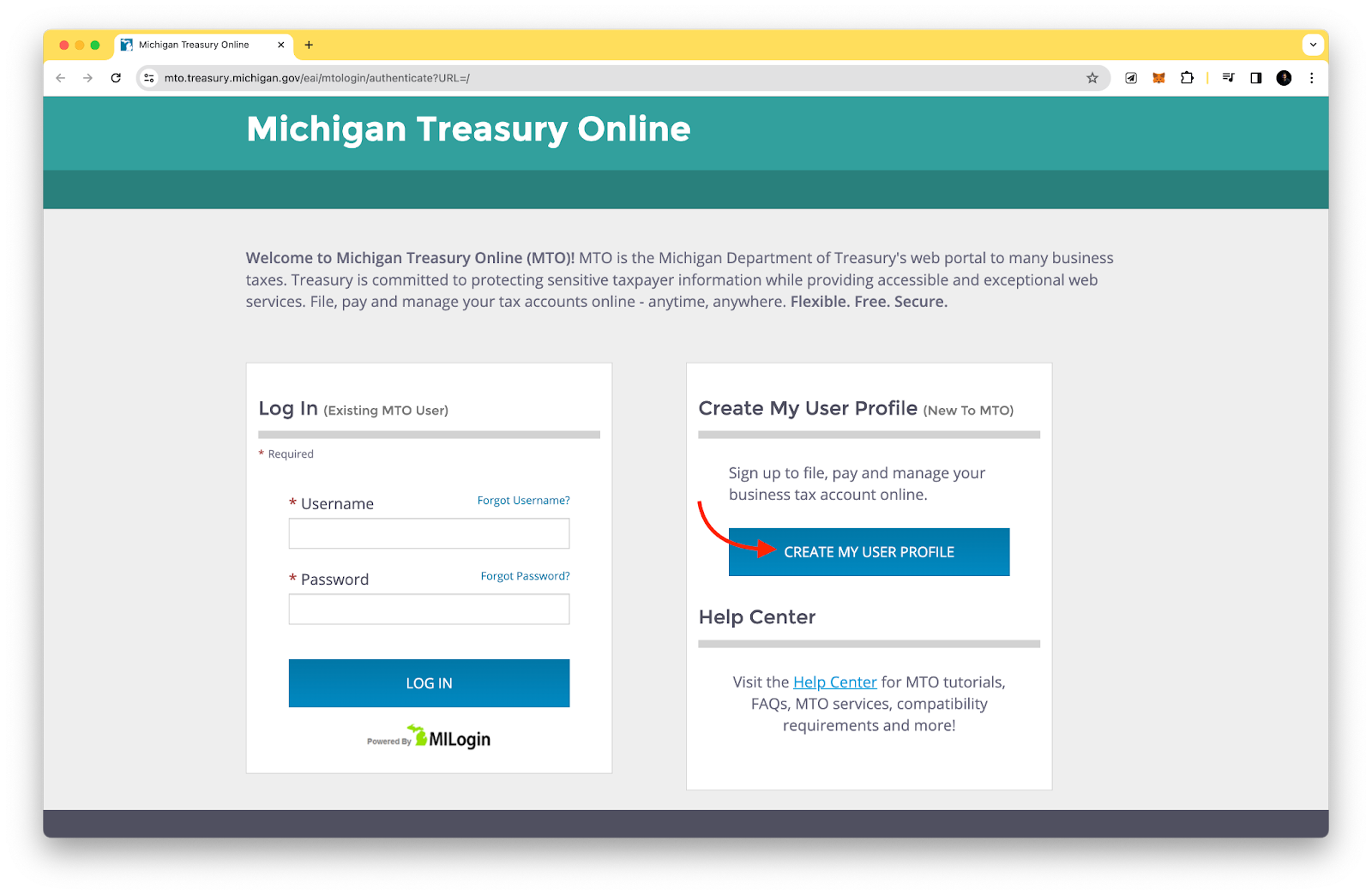

Step 1: Create an account on the Michigan Treasury Online (MTO)

To begin, follow this link: https://mto.treasury.michigan.gov/eai/mtologin/authenticate?URL=/.

This will take you to the Michigan Treasury Online login screen.

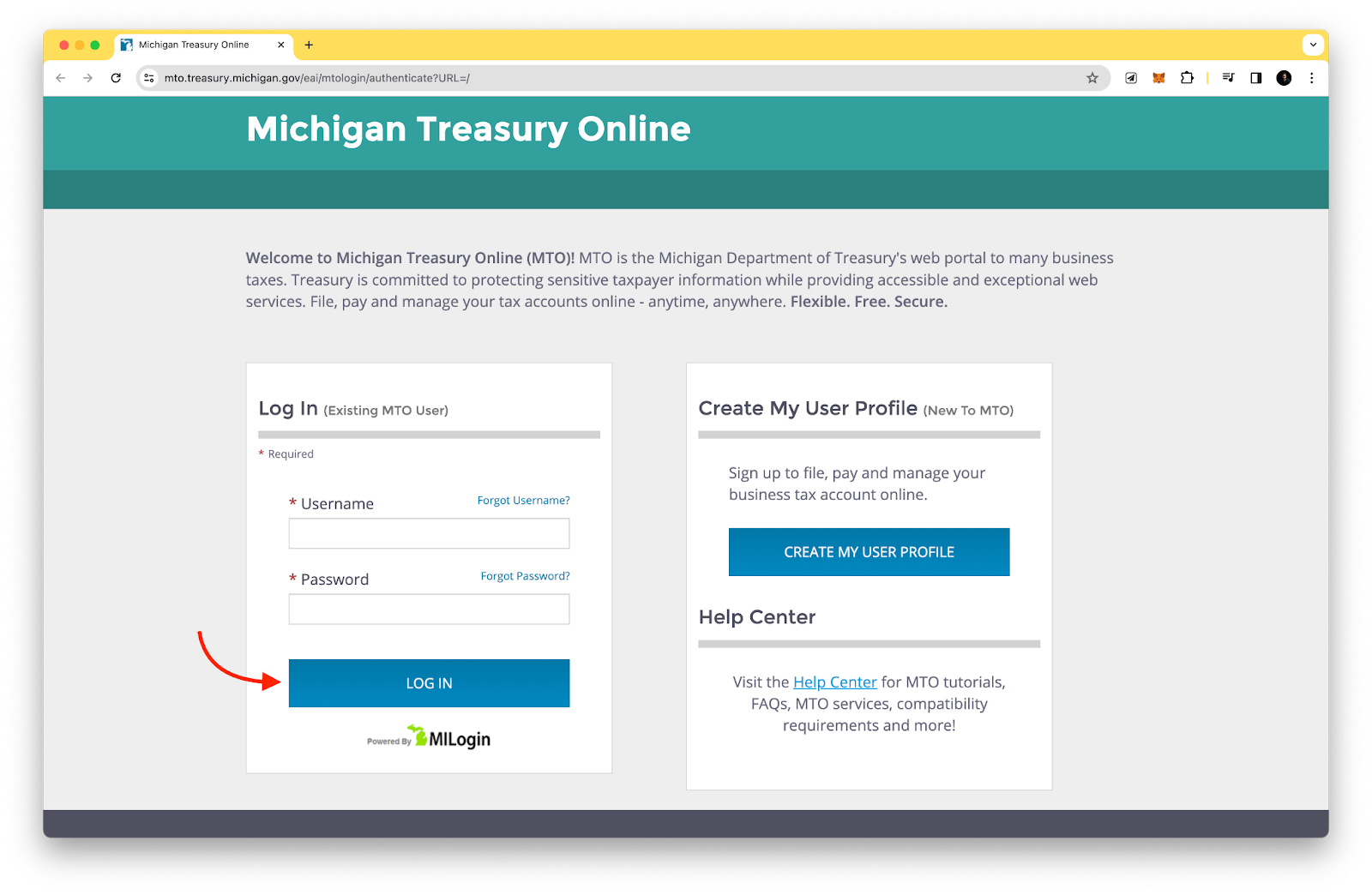

Step 2: Sign in to the MTO account

Enter your username and password to access your account. If you don't have login credentials, you'll need to set them up.

These are typically created when you submit your registration paperwork for a sales tax permit. If you need assistance obtaining a permit or setting up your state login, consider using a service like TaxValet.

Step 3: Navigate to the sales, use, and withholding (SUW) tax information

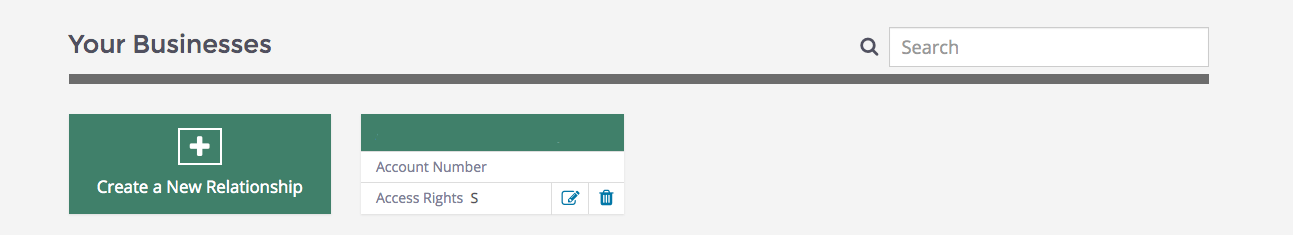

Once you're logged in, you'll be directed to your dashboard.

Take a moment to familiarize yourself with the various links and options available.

To proceed, click on the green "Sales, Use, and Withholding (SUW) Tax" box. You'll then see a box with your business name at the top.

Click on your business name to continue.

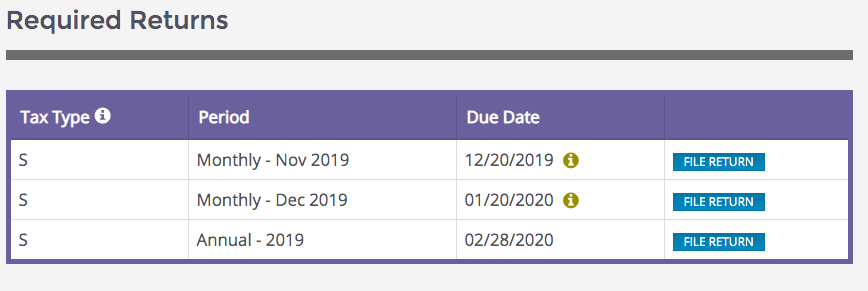

Step 4: Choose the filing period

On the next page, you'll see two headings: "SUW Summary" and "SUW Actions."

Under the "SUW Actions" heading, locate the "File & Pay Options" tab and select "File and Pay a Tax Return."

Next, you'll see a list of available filing periods. Select "File Return" next to the period for which you need to file. You may be prompted to clarify which taxes you need to file.

If you're only filing a sales tax return, select that option. If you're filing both sales and use tax returns, select both options.

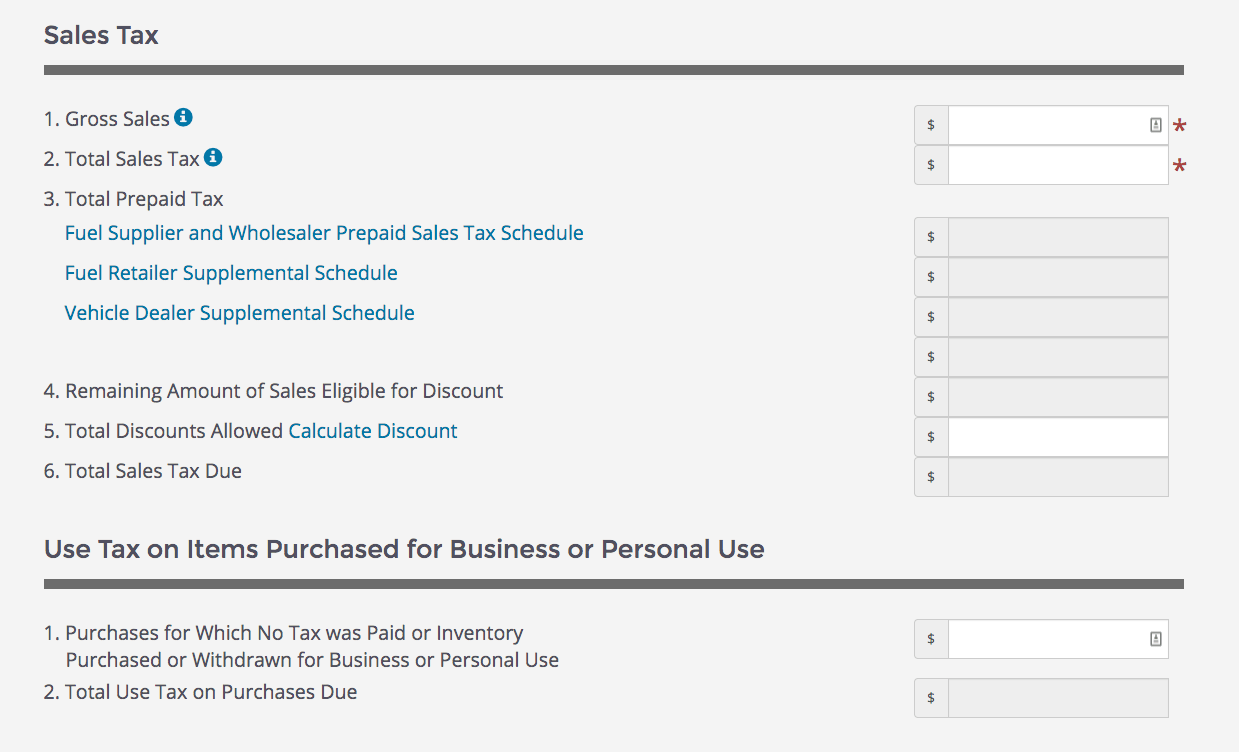

Step 5: Enter your sales data to auto-calculate sales tax

You'll now see a screen where you can enter your sales data. Start by entering your gross sales, which include shipping and handling, in the top field. Hover over the blue "i" icon for more information on what to include.

Next, enter your total sales tax due. This should be your gross sales from box 1, minus any allowable deductions, multiplied by 6% (0.06). Again, you can hover over the blue "i" icon for details on what to include.

If line 3 applies to you, select the related schedule and complete it. Hover over each link to determine if they apply to your situation.

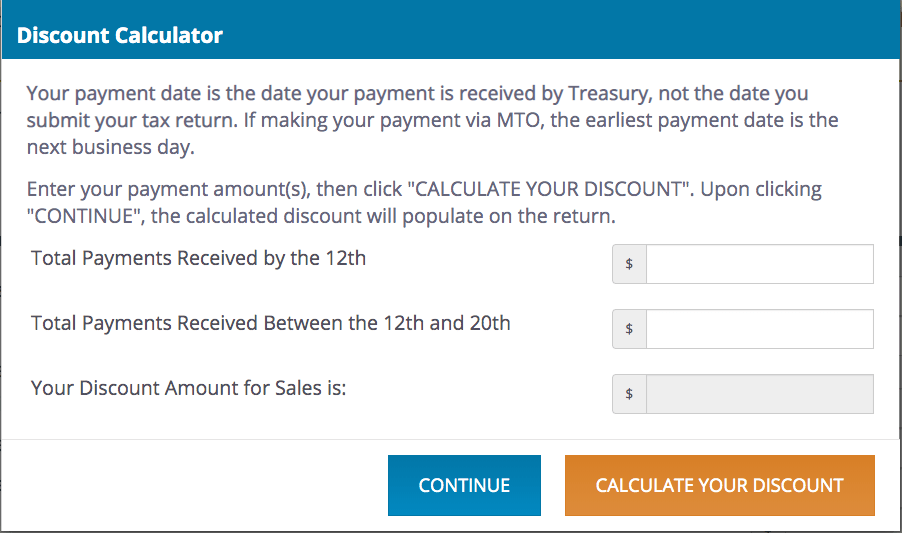

Step 7: Calculate the discount

Michigan offers a discount to businesses for filing and paying their sales and use tax returns on time. To calculate this discount, select "Calculate Discount."

Enter the tax payment amount and the date you plan to remit the payment. For example, if you plan to pay on the 14th of the month, enter the payment amount in the "Total Payments Received Between the 12th and 20th" field. Press "Calculate Your Discount" to apply the discount to your return, then click "Continue."

If you have any use tax to pay, fill out the corresponding box with the dollar amount of purchases on which no sales tax was paid. Line 2 will auto-populate with the correct tax amount.

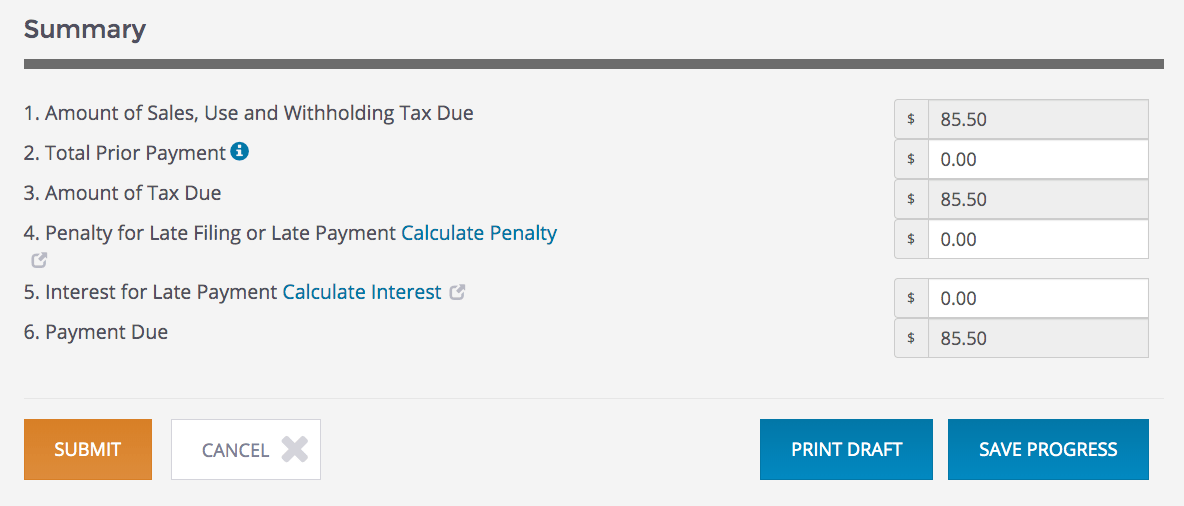

Step 8: Review the summary page

On the summary page, you'll see the tax due from the previous steps in line 1. If you have any prior payments or overpayments from a previous return that you wish to apply to this return, enter that amount in line 2.

If you're filing the return late, you'll need to calculate penalties and interest by clicking the provided links.

Michigan offers a convenient way to calculate penalty and interest. Once you've entered all the necessary information on the summary page, review the entire return for accuracy, then press the "Submit" button.

Step 9: Verify and file your sales tax return

After submitting, you'll be asked to verify your name and title within the company. Check the box at the bottom and press "File" to officially submit your return.

Congratulations! You've successfully filed your Michigan sales tax return.

Paying Your Sales Tax

If you wish to pay your sales tax while submitting the return, select that option after filing. Alternatively, you can return to the dashboard, select "Make a Payment," and then "Pay Now."

On the payment screen, ensure that the payment type, month, and year are correct. In the bottom portion of the screen, enter the sales tax payment amount in the top-left box where the "Tax Amount" column and "Sales Tax" row intersect. If you have any penalties, interest, or use tax, enter those amounts in the corresponding fields.

After verifying that all information is correct, press "Pay."

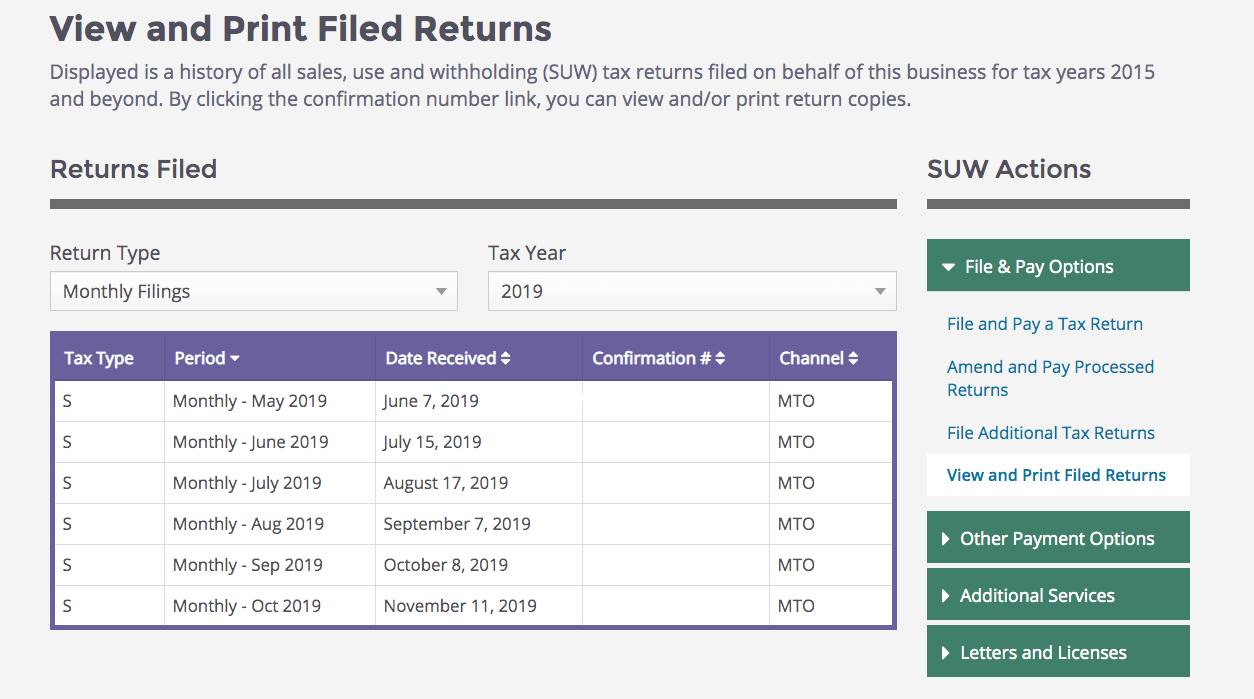

Printing or Saving Your Return

If you forgot to print or save a copy of your sales tax return, Michigan provides an easy solution.

Go back to the dashboard and under the "File & Pay Options," click "View and Print Filed Returns."

Select the confirmation number related to the return you wish to print or save.

Local Sales Tax

It's important to note that Michigan does not have local sales tax rates. The state maintains a uniform 6% sales tax rate across all jurisdictions. This simplifies the filing process, as you don't need to worry about calculating and reporting sales tax for individual cities or counties.

FAQs

When are Michigan sales tax returns due?

Monthly returns are due on the 20th of the following month. Quarterly returns are due on the 20th of the month following the end of the quarter. Annual returns are due on February 28th of the following year.

What if I need help filing my Michigan sales tax return?

You can contact the Michigan Department of Revenue directly at (517) 636-6925 between 9:00 a.m. and 4:00 p.m. EST. Additional resources are available on the Michigan Department of Revenue website. Consider using a service like TaxValet's Done-for-You Sales Tax Service for expert assistance.

What happens if I file my sales tax return late?

Late filings may result in penalties and interest charges. Michigan provides a convenient way to calculate these amounts when filing your return.

Simplify your sales tax compliance with Numeral

Dealing with sales tax can be a headache, especially for ecommerce businesses. But it doesn't have to be that way. Numeral is here to make your life easier and take the stress out of sales tax compliance.

With Numeral, you can:

- Spend less than 5 minutes on sales tax compliance and focus on your business

- Avoid inaccurate or delayed filings to eliminate worries about penalties

- Get expert support from licensed tax professionals

- Automate your sales tax collection and remittance

Numeral connects seamlessly with your online store and handles everything from monitoring your sales to registering your business in the states where you have nexus. No more worrying about keeping up with changing tax laws or spending hours on paperwork. Numeral has got you covered.

.jpg)